'Danny Turner' isn't his real name.

But the scams he promotes certainly are.

'My Advertising Pays'.

Danny was a big player in MAP. He appeared in Leaders videos and helped recruit loads of people.

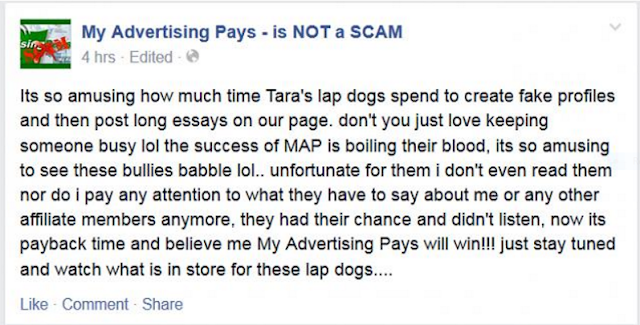

He also set up a Facebook page called 'My Advertising Pays is NOT a Scam' and was a vicious admin.

Now he wants you to believe that he's a changed man and was lied to and conned by Mike, Tony and Lynne.

He calls them scammers and wants you to join the fight against them.

But these are just hollow words from a coward who doesn't want to do jail time for promoting a scam, something he's had plenty of practice at.

He joined Empower, and somehow managed to miss seeing Simon Stepsys promoting it.

This is just one of the posts from a blog he ran that has also since been deleted:

Empower was also a Ponzi Scam. So was Banners Broker.

Let's look at some of Dannys other 'businesses'.

Likes XL - another scam.

Digital Altitude - another scam.

https://www.ftc.gov/news-events/press-releases/2018/02/ftc-obtains-court-order-halting-business-coaching-scheme

http://behindmlm.com/companies/digital-altitude/digital-altitude-cannot-operate-lawfully-and-profitably-says-receiver/

Danny is heavily into marketing or 'Team Building', which is another name for gathering as many names as he can, so he can sell his next venture to them:

And judging by the comments on HashFlares Facebook page, it certainly looks like a scam to me:

HASHFLARE has closed down:

...to malicious sites!

This a post from Danny promoting USI TECH - another ponzi scam (now closed)

At best, Danny's judgement is crap. At worst, he 100% knows exactly what it is he promotes and doesn't care who loses money as long as he gets his referral commissions.

And he lies:

UPDATED 8th May 2019:

There's an interesting development in this story. A leopard never changes it's spots!

An author called 'Dutchmanripper' wrote these posts on the comments section:

'Here is a cover letter to summarize the criminal activity Danny Turner has been up to:Regarding the Thief and Con Artist named Doede Osman KHAN Known on the Internet by the alias of Danny and Daniel Turner

26 April, 2019

Dear Sir/Madam,

We are a group of online investors from whom Doede Osman Khan (using the online alias of Daniel Turner, from the maiden name of his wife) has stolen an estimated 80 BTC from us through pretending to invest our funds in online cryptocurrency trading programs. For those who are unfamilar with Bitcoins or cryptocurrencies, this is equivalent to over £300,000. Despite the fact that Doede Osman Khan (aka 'Danny' aka 'Daniel Turner') has all of our contact information, he has refused to communicate with us, has refused to pay us our dividends, and refuses to return our original investments. Our group of 38 investors is currently organizing civil and criminal actions against Doede Osman Khan (aka 'Danny' aka 'Daniel Turner').

Doede Osman Khan is not poor. In addition to his personal Bitcoin wallets at legitmate organizations like Binance and BitPanda (estimated as holding at least 200 BTC, or over £750,000), Doede owns a house worth over £240,000, and has been involved with over 10 companies between Mar 2012 and Apr 2019, some of them registered using the fake name of 'Daniel Turner'.

Doede Osman Khan will deny that he owes us our money, claiming we are 'haters', or we are jealous of his success, or that we have no proof, as he appears to have done so many times in the past. We challenge him to get a lawyer and contact us - we have plenty of evidence and all 38 members of our group are willing to swear affadavits, and provide enough evidence to support a criminal investigation.

In order to verify that we are speaking the truth and have evidence agaisnt Doede Osman Khan (aka 'Danny', aka Daniel Turner), please visit our website at the address provided below and read the redacted report that has been compiled for us by our private investigator. You will be able to read for yourself that Doede Khan and Daniel Turner are the same person who stole investment funds from 38 investors.

Sincerely,

The 38 investors of the online crypto-currency community who want their money back,

Informally known as 'The People Vs Daniel Turner alias Doede Osman Khan'

(website address here)'

These are some of his posts:

When the inevitable happened and MAP started running into problems, Danny took the cowards way out and started to distance himself from MAP.

He changed the name of his Facebook page to 'Against Cyber Bullying' and deleted all the posts he'd written.

Now he wants you to believe that he's a changed man and was lied to and conned by Mike, Tony and Lynne.

He calls them scammers and wants you to join the fight against them.

But these are just hollow words from a coward who doesn't want to do jail time for promoting a scam, something he's had plenty of practice at.

He joined Empower, and somehow managed to miss seeing Simon Stepsys promoting it.

This is just one of the posts from a blog he ran that has also since been deleted:

Empower was also a Ponzi Scam. So was Banners Broker.

Let's look at some of Dannys other 'businesses'.

Likes XL - another scam.

Digital Altitude - another scam.

https://www.ftc.gov/news-events/press-releases/2018/02/ftc-obtains-court-order-halting-business-coaching-scheme

http://behindmlm.com/companies/digital-altitude/digital-altitude-cannot-operate-lawfully-and-profitably-says-receiver/

...with Aspire

Danny is heavily into marketing or 'Team Building', which is another name for gathering as many names as he can, so he can sell his next venture to them:

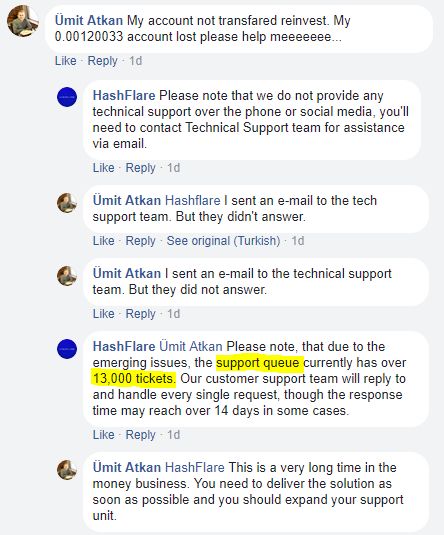

Danny has predictably now jumped on the Crypto bandwagon and is pushing

'HASHFLARE'

- which has a scam warning against it already.

And judging by the comments on HashFlares Facebook page, it certainly looks like a scam to me:

****UPDATE 26th July 2018

Despite Danny proclaiming it was legit:

And ever helpful, Danny offers 'tips':

...to malicious sites!

This a post from Danny promoting USI TECH - another ponzi scam (now closed)

Dear USI-TECH Believers,

People have suffered from many programs over the years running out of money, meaning the account balances people see are not backed up by any real money. Some of those scams lasted years. Wouldn't it be good to detect this sort of thing early? Wouldn't it be great if we helped people avoid these problems?

The real offer on USI-TECH (which everyone can see) is to pay money to USI-TECH, and each day they will receive some money on their account until they reach 140% -- which is predicted to be in approx 140 business days (only trading Mon-Fri). The description for where this money is coming from is on the website too: Trading in crypto-currencies; which they say they typically get up to 150% returns for their clients annually.

They also say they typically trade for clients investing a minimum of $100,000. Now they are accepting everyone to tap into their trading abilities. So money spent is constantly being described as being used in trades to get returns for the client. This is the very definition of what a security is. I'm certain you can see this all for yourself.

So if this sort of offer holds concern whether or not it's a real investment or just a ponzi which runs out of money and can't pay balances.. to protect consumers a company really should help the potential client see with absolute certainty that when they invest with this company their money will be used as described and returns will come from the common enterprise as described.

So if this sort of offer holds concern whether or not it's a real investment or just a ponzi which runs out of money and can't pay balances.. to protect consumers a company really should help the potential client see with absolute certainty that when they invest with this company their money will be used as described and returns will come from the common enterprise as described.

That's why I keep talking about 3rd party accounting firms to verify the books are legit and the returns are truly coming from trades. Then the problem next comes--

what if this 3rd party accounting firm has been paid large sums of money to lie on behalf of the company? The only way to be certain is to have the government double check into everything.

what if this 3rd party accounting firm has been paid large sums of money to lie on behalf of the company? The only way to be certain is to have the government double check into everything.

This is why it's vital for an offer such as USI-TECH to be registered with the SEC, and not have people out there lying about it.. or saying they don't need to be registered with the SEC, because the SEC's alert just basically disproved everything people have been saying about USI-TECH not needing to be registered with the SEC because it transacts off-shore and with bitcoin.. the statement from the SEC says the complete opposite when the SEC is empowered to protect USA citizens from frauds, even if they originate offshore. So definitely USI-Tech should register with the SEC to simply prove their offer is legit, and without that in place-- the offer should be questioned and doubted by default.

At best, Danny's judgement is crap. At worst, he 100% knows exactly what it is he promotes and doesn't care who loses money as long as he gets his referral commissions.

And he lies:

'I was the one who called them out before they stopped paying people!'

No, Danny. WE were.

'...the money they used I gave them to invest'

Seriously, Danny!

'first online business I had ever been in...' 100% LIE, Danny!

And the real Danny is never far away...

'...you should be grateful there are people like me who made mistakes and warn people so you don't have to do the same.'

UPDATED 8th May 2019:

There's an interesting development in this story. A leopard never changes it's spots!

An author called 'Dutchmanripper' wrote these posts on the comments section:

'Here is a cover letter to summarize the criminal activity Danny Turner has been up to:Regarding the Thief and Con Artist named Doede Osman KHAN Known on the Internet by the alias of Danny and Daniel Turner

26 April, 2019

Dear Sir/Madam,

We are a group of online investors from whom Doede Osman Khan (using the online alias of Daniel Turner, from the maiden name of his wife) has stolen an estimated 80 BTC from us through pretending to invest our funds in online cryptocurrency trading programs. For those who are unfamilar with Bitcoins or cryptocurrencies, this is equivalent to over £300,000. Despite the fact that Doede Osman Khan (aka 'Danny' aka 'Daniel Turner') has all of our contact information, he has refused to communicate with us, has refused to pay us our dividends, and refuses to return our original investments. Our group of 38 investors is currently organizing civil and criminal actions against Doede Osman Khan (aka 'Danny' aka 'Daniel Turner').

Doede Osman Khan is not poor. In addition to his personal Bitcoin wallets at legitmate organizations like Binance and BitPanda (estimated as holding at least 200 BTC, or over £750,000), Doede owns a house worth over £240,000, and has been involved with over 10 companies between Mar 2012 and Apr 2019, some of them registered using the fake name of 'Daniel Turner'.

Doede Osman Khan will deny that he owes us our money, claiming we are 'haters', or we are jealous of his success, or that we have no proof, as he appears to have done so many times in the past. We challenge him to get a lawyer and contact us - we have plenty of evidence and all 38 members of our group are willing to swear affadavits, and provide enough evidence to support a criminal investigation.

In order to verify that we are speaking the truth and have evidence agaisnt Doede Osman Khan (aka 'Danny', aka Daniel Turner), please visit our website at the address provided below and read the redacted report that has been compiled for us by our private investigator. You will be able to read for yourself that Doede Khan and Daniel Turner are the same person who stole investment funds from 38 investors.

Sincerely,

The 38 investors of the online crypto-currency community who want their money back,

Informally known as 'The People Vs Daniel Turner alias Doede Osman Khan'

(website address here)'

But then suddenly, the comments that 'Dutch' left were removed and he sent me another post saying Danny had refunded all his money. WHY? Because Danny told him that if he removed all the bad things he said about him, he could have his money back!

Which proves conclusively that the money given to Danny in the first place went straight into his OWN pocket - or how else how could he refund it!

https://danielturnerthescammer.home.blog/

16th August 2019

Danny's bit off more than he can chew this time. The article in todays Times newspaper is all about him and refers to the post above:

https://www.thetimes.co.uk/edition/news/action-fraud-ignored-dossier-detailing-bitcoin-scam-n7s92d25l?fbclid=IwAR0nGYIRfeBdBl

And I've recently come across this Facebook post which Danny posted sometime before USI TECH crashed:

16th August 2019

Danny's bit off more than he can chew this time. The article in todays Times newspaper is all about him and refers to the post above:

https://www.thetimes.co.uk/edition/news/action-fraud-ignored-dossier-detailing-bitcoin-scam-n7s92d25l?fbclid=IwAR0nGYIRfeBdBl

And I've recently come across this Facebook post which Danny posted sometime before USI TECH crashed:

Dear USI-TECH Believers,

People have suffered from many programs over the years running out of money, meaning the account balances people see are not backed up by any real money. Some of those scams lasted years. Wouldn't it be good to detect this sort of thing early? Wouldn't it be great if we helped people avoid these problems?

The real offer on USI-TECH (which everyone can see) is to pay money to USI-TECH, and each day they will receive some money on their account until they reach 140% -- which is predicted to be in approx 140 business days (only trading Mon-Fri). The description for where this money is coming from is on the website too: Trading in crypto-currencies; which they say they typically get up to 150% returns for their clients annually.

They also say they typically trade for clients investing a minimum of $100,000. Now they are accepting everyone to tap into their trading abilities. So money spent is constantly being described as being used in trades to get returns for the client. This is the very definition of what a security is. I'm certain you can see this all for yourself.

So if this sort of offer holds concern whether or not it's a real investment or just a ponzi which runs out of money and can't pay balances.. to protect consumers a company really should help the potential client see with absolute certainty that when they invest with this company their money will be used as described and returns will come from the common enterprise as described.

So if this sort of offer holds concern whether or not it's a real investment or just a ponzi which runs out of money and can't pay balances.. to protect consumers a company really should help the potential client see with absolute certainty that when they invest with this company their money will be used as described and returns will come from the common enterprise as described.

That's why I keep talking about 3rd party accounting firms to verify the books are legit and the returns are truly coming from trades. Then the problem next comes--

what if this 3rd party accounting firm has been paid large sums of money to lie on behalf of the company? The only way to be certain is to have the government double check into everything.

what if this 3rd party accounting firm has been paid large sums of money to lie on behalf of the company? The only way to be certain is to have the government double check into everything.

This is why it's vital for an offer such as USI-TECH to be registered with the SEC, and not have people out there lying about it.. or saying they don't need to be registered with the SEC, because the SEC's alert just basically disproved everything people have been saying about USI-TECH not needing to be registered with the SEC because it transacts off-shore and with bitcoin.. the statement from the SEC says the complete opposite when the SEC is empowered to protect USA citizens from frauds, even if they originate offshore. So definitely USI-Tech should register with the SEC to simply prove their offer is legit, and without that in place-- the offer should be questioned and doubted by default.